The Power of Digital Lending Transformation: Human, Accessible, and Efficient Finance

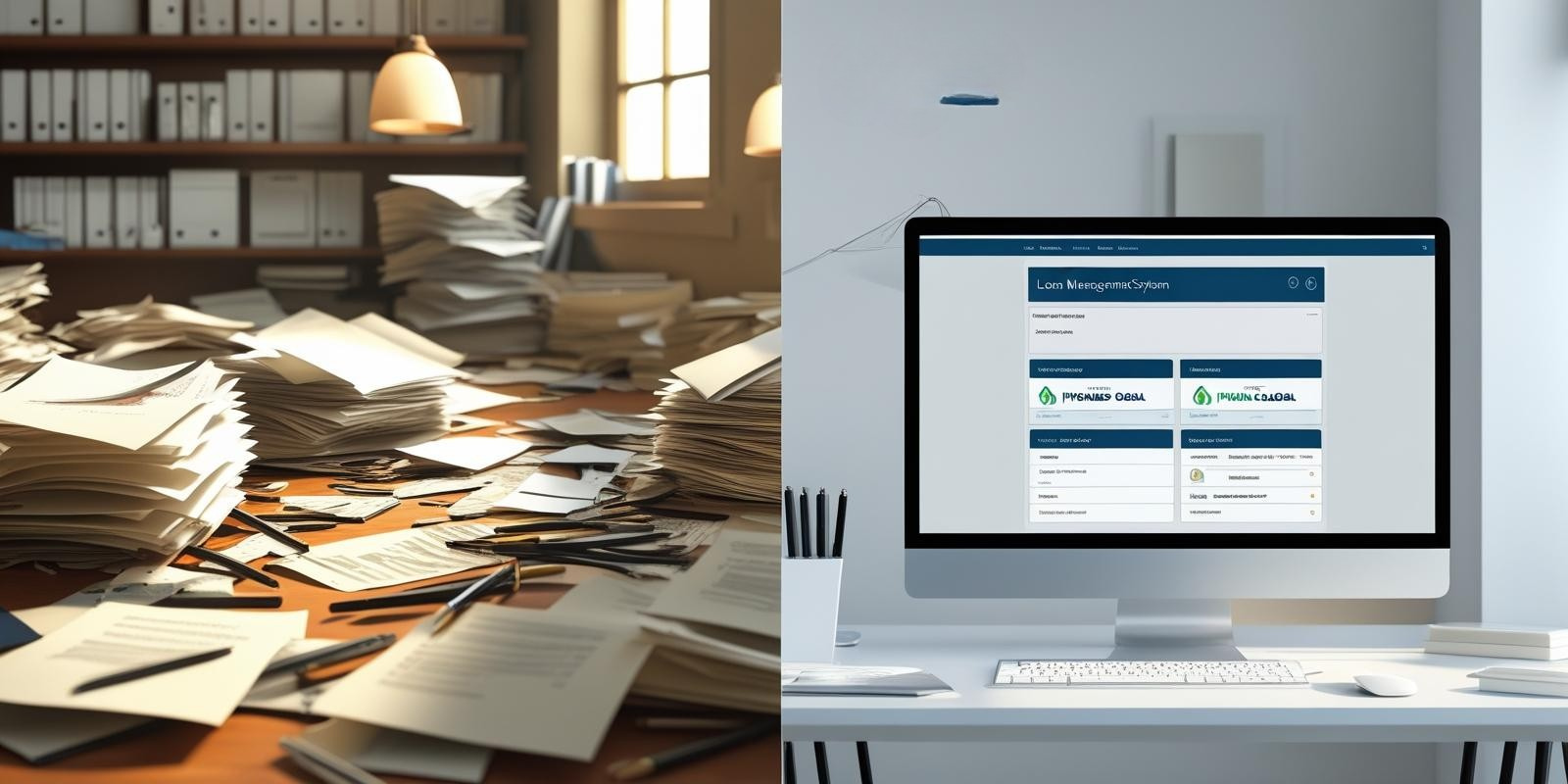

In today’s modern world, the need for faster, more intelligent and more convenient financial solutions has never been greater. Traditional lending is notorious for its heavy paperwork, stringent approval criteria, and lengthy application waiting times, which is a business owner’s nightmare. But that landscape is shifting — and digital lending is at its center.

? Sign up for a 30 day free trial and reimagine lending.

Sign up for a 30 day free trial

What is Digital Lending?

Loans facilitated through digital platforms and technologies - free from brick and mortar branches, tedious paperwork, and long approval waits - are termed digital lending. It uses AI, ML, data analytics, and other cutting-edge technologies to simplify every aspect of the loan process — from the time it takes to find a borrower, to the speed it takes for that borrower to secure funds, all the way through repayment.

With just a smartphone or computer, customers can now:

• Apply for a loan within minutes

• Upload documentation digitally

• Receive real-time loan status updates

• Get funds disbursed directly into their bank accounts—often on the same day

? Sign up for a 30-day trial to explore how digital lending can work for you or your business .https://finguardgl.com/signup

Why It Matters: Real Impact for Real People

Digital lending isn’t just about convenience—it’s about inclusion.

Let’s consider two examples:

• Ravi, a small tea vendor in a semi-urban area, wanted to expand his business. Traditional banks turned him down due to his informal income.

• Meena, a young woman starting her own tailoring service, lacked a credit history and was overlooked by conventional lenders.

Through digital lending platforms, both were able to access affordable credit based on alternative data—such as mobile transactions and payment behavior—rather than outdated financial indicators. Today, Ravi has scaled his business, and Meena employs other women in her community.

? Sign up for a 30-day trial and see how technology can improve your financial decision-making. Sign up for a 30 day free trial

How It Works: The Technology Behind the Transformation

Modern digital lenders use a combination of:

• Artificial Intelligence (AI) to assess risk and automate decisions

• Machine Learning (ML) to analyze patterns in financial behavior

• Alternative data (e.g., mobile usage, UPI transactions, utility bills) to evaluate creditworthiness

This technology allows lenders to make faster, fairer, and more accurate decisions—while significantly reducing operational costs.

? Sign up for a 30-day trial and discover smarter ways to lend, borrow, and grow.

https://finguardgl.com/signup

Benefits of Digital Lending

• Speed: Loan approvals can happen within minutes.

• Convenience: End-to-end digital experience via mobile or web platforms.

• Inclusivity: Serves individuals and small businesses who may lack formal credit histories.

• Transparency: Clear loan terms, repayment schedules, and minimal human bias.

• Security: Enhanced cybersecurity protocols to protect customer data and transactions.

? Sign up for a 30-day trial and take the first step toward modernizing your lending experience.

Sign up for a 30-day trial

Transforming the Financial Landscape

The power of digital lending lies not just in automation, but in its ability to restore humanity to financial services. It recognizes that borrowers are more than just numbers—they are individuals with dreams, ambitions, and potential.

As digital lending continues to evolve, we can expect:

• More personalized loan products

• Wider access across rural and semi-urban geographies

• Stronger regulatory frameworks to ensure responsible lending

• Greater collaboration between banks and fintech companies

conclusion

The digital lending revolution is redefining how credit works—not just for banks and institutions, but for everyday people. By leveraging technology to create more accessible, inclusive, and empathetic lending experiences, we’re not only transforming finance—we’re changing lives.

Want to experience it for yourself? ? Sign up now for a 30-day trial and reimagine lending. Sign up for a 30-day trial

Let’s connect. Reach out to us to explore how digital transformation can reshape your lending journey.